There’s something that many people have been saying these days: “this is not the time to buy houses, don’t do it.” We would consider that yes, it is time to buy a house, but you shouldn’t pay for it now. It is better to do what we are going to explain in this article.

The first thing we want you to think about is the concept of “inflation.” The easiest way to define this is by thinking about the rise in prices of products and services. That translates into a decrease in our purchasing power and our savings.

Now that we know what inflation is, we have to think about how it happens, and because there are many reasons, we are going to describe some situations that can be generated as a result of it in terms of your economy.

What can inflation generate in people’s economy?

First Scenario

Over the years, the cost of products and services can go up. For instance, let’s say that in 1990 five tomatoes cost $3. Then, in 2000, the same tomatoes went on to cost $4, and over time they went up to $5, and then $6. The same thing happened with other products.

Taking into account this inflationary process, there are companies that simply increase the salary of their employees. This is the case of JP Morgan, which went from paying first-year analysts $85,000 a year, to $100,000. In this case, users adapt to inflation, without putting their purchasing power at risk.

Second Scenario

On the other hand, we have that the products also go up in price, but people with blue-collar jobs simply have to adapt to the new prices with the same monthly or annual income.

Those are people with factory or production jobs, where you don’t necessarily need a university degree, and as long as you know how to operate the machinery, you can do it.

Generally, these types of jobs do not have a good adjustment to inflation, and if they do, it is such a minimal adjustment that it does not end up compensating for the rise in prices in the products.

Third scenario

To respond to the inflation that generates price increases, many people decide to gradually eliminate the acquisition of things, or the payment of services in their monthly expense. Also thinking about the five tomatoes, you may decide to buy them, or instead, you go to buy two liters of milk, because you no longer have enough money to buy all the things.

Fourth scenario

This one has been the most common for the last 10 to 20 years, at least in the United States. It happens that products increase over time, but most consumers are always able to adapt to the new prices. This happens because the Government prints money and begins to inject it into the economy. In 2008 they did it through Quantitative Easing, and you can learn more about this topic by clicking here.

Recently, in 2020, we had the stimulus check, which aims to stimulate the economy. The people receive that money, and the Government prints, prints, and prints while everyone goes out to spend. When people go out to spend money, the quantity of supplies/products does not match the demand and is limited, therefore companies begin to raise the price of their products.

There are endless scenarios that can be generated as a result of inflation, but those are the ones that we chose to give you a clearer idea of this concept. What we must clarify is that, in no case is inflation good, unless it stays at 2% per year, because the cost of living has to rise, but when it rises excessively it is not good.

Real estate: the best way to hedge against inflation

In the case of buying houses, you can use inflation to your advantage through debt. Remember, as we have explained in previous articles, that there are good debts and bad debts.

Bad debts are all those that first represent an expense, and then the sacrifice of having to work, even double time to pay them. In the case of good debts, they are those that pay themselves through an asset that we acquire, and which generates cash flow.

During an inflationary process, many people invest with good debts, so that later when they have to pay them the currency is devalued, and the process is beneficial for them. Debts should not be feared, rather you have to respect them and know how to work with them, because they can represent an ally when expanding your investments.

Buy a house now and don’t pay for it

This is a concept that for some people may sound confusing, but we will explain it. When we say that it is time to buy a house and not pay for it, we refer to the fact of acquiring real estate through the concept of Other People’s Money (OPM).

Other People’s Money is basically the money of the bank, money that is “given” to you through mortgages, credit cards, and other types of loans. The technique here is that you use that money to invest in an asset that will generate income, and thus pay that back.

In addition to that, you can do it with cheap money, since if you use 0% credit cards, you would not have interests to pay. Clearly, you have to pay off that credit card before the 0% period expires. In terms of mortgages, we are currently facing the lowest interest rates in the market in history, there is no doubt about that.

How to use inflation to our advantage?

The first thing you should do is start to see money in a different way, because we have been wrongly educated about money. For many people, money is synonymous with wealth, but in real life, money is synonymous with productivity and time to grow as a professional and investor, or to spend more moments with your family.

Simply having money does not make you rich, because money does not reproduce itself. In fact, storing your money during an inflationary period is the worst thing you can do because its value is decreasing, and that’s why rich people do not leave their money in savings accounts. Instead, they invest it.

Real money vs. Nominal money

Inflation causes the value of things to rise nominally, as has happened in Zimbabwe or Venezuela, countries in which every few years they change the currency or subtract zeros to simplify operations, but in reality, the bills are worth the same, or even less.

If you understand the difference between real money and nominal money, you are ready to fight inflation intelligently with good debts. The point is to understand that real money allows you to buy more things, but nominal money don’t, that is a big difference.

The best example is to think about this scenario: let’s say you bought a house in 2000 for $120,000 with a 20% down payment. Your mortgage came out at $515 between principal and interest, and you at that time had a monthly income of $3,750.

Now, in 2020, that house appreciated in value. Among this appreciation we are taking into account inflation, because the cost of living rises every year, ideally 2%, in addition to the quality of the area, the neighborhood, and other factors that contribute to the appreciation. Now, as time goes by, you have a house that is valued at $260,000, but you only paid $120,000 for it 20 years ago.

Today, a mortgage for the current price of that house would be $878, but you are paying $515. The point of all this is that, over the years, your income adjusted for inflation, and while in 2000 you earned $3,750, now you earn $5,000 a month. The idea of this strategy is to take advantage of today’s situation, and know that you can generate value based on inflation.

Monitoring the real estate market is very important

Changes in the world always influence the real estate market and house prices. A few months ago, we were talking about migration and work. There are people who have gone to New York, left the metropolitan areas looking for bigger houses, because now they work from home.

Now that things are going back to normal, we see that metropolitan cities are growing again and generating demand. Now, many people are looking to live in the big cities again.

Similarly, according to our data, houses are not going to drop in price because the market is not enough. This was something that had been talked about for a long time, the price of the houses are not going down because the market has been behind for years.

What is happening with the real estate market in the United States?

According to several articles that we have analyzed, the lack of supply of houses is not because there is no wood, as they have been showing in the newspapers. What happens is that, as happened in 2008, many people panicked and began to moderate construction because they were afraid to build, and that another bubble would fall again, leaving all the houses stranded.

According to a 2019 map, published by the National Association of Realtors, already in that year there was a low supply of houses in areas such as:

– Miami.

Ads

– New York.

– Boston.

– Alabama.

– Texas.

– Pittsburgh.

With the pandemic, this whole situation worsened because many people decided to stay at home taking advantage of the stimulus check, or they simply did not go to work out of fear. The low movement of wood from one state to another generated a domino effect that has further delayed the supply of real estate.

It is time to think about the value, and not the price of the houses

If I ask you if you want to buy cheap houses, you will surely say yes. But, if I ask you if you are willing to invest any amount, knowing that you will generate a return of 30%, 40%, or more, surely you will also say yes, and that is what all this translates into. The cost of entry does not matter, as long as you can generate an investment or a profit with it.

Home prices take a backseat when we think about the value we can generate, and this is something that many of you have already implemented. Prices may be going up, but when you do the math, you may find that there is cash flow to pay, for example, property management, mortgages, and more.

Now, once again, it is better to buy a house today, because you will pay for the houses with money from the bank and that translates into OPM and cheap money, because the bank’s money is money from other people who deposit it, and it is cheap because the interest rates are low.

In addition to that, the rent that you are collecting from your tenant will be used to pay that debt. Over time, the mortgage will lose value because the debts are fixed and do not adjust for inflation, while the real money you use to pay, does.

The price of renting a house

Projections indicate that houses will continue to rise in value, and it is important to emphasize that, these are projections and not predictions. Rents are also anticipated to continue to rise in value over the years due to high demand for homes, because the entry point is very high.

People who want to buy a house cannot, and if they have to decide between buying and being homeless, they will choose to rent. Again, to emphasize, do not keep the money with you, because that loses value. Instead, you better get assets that make money for you, but do it wisely.

How to invest in real estate wisely?

The first thing to do is do a good job of researching the real estate market, and buy based on numbers. Do not participate in bidding wars.

Now, suppose you did everything you could, you got stuck in that market you want to buy and you can’t get more money, you just have to use what you already have to generate debt. This can be done with HELOC or Cash-Out Refi.

You get that money, and you keep it with you until you can reinvest it in another type of asset, or by the time you get the house you were looking for. Remember that by acquiring capital, you are not obtaining wealth, it is simply a vehicle to continue growing.

As we discussed before, when you obtain a debt, you do so with a nominal amount that is related to the prices of the real estate market. The logic that we used before to buy a house is the same that you would be applying when you’re getting a HELOC or a Cash-Out Refi with those properties. The debt loses value and the rent is being paid by your tenant.

Historical Analysis of the United States Real Estate Market

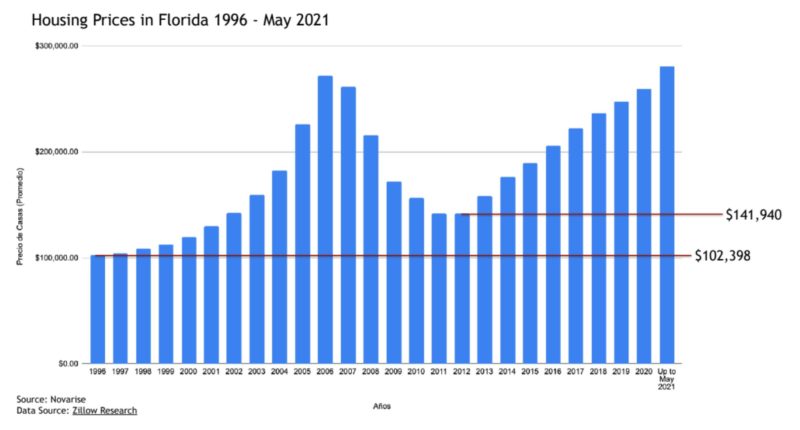

Florida

This graph shows the value of homes in Florida from 1996 to May 2021. Analyzing the numbers, we can see that the lowest point of the average price of a house in Florida is in 1996, with $102,398.

Another of the lowest points in recent history occurred in 2012, reaching $141,940. All this happened after a big rise in prices, which began to fall in 2008.

This means, and when looking at the graph you can see, there will always be a new rise and a new decline, because the market always needs to correct itself. What you need to determine is when the new downturn will be, bearing in mind that it will not be the same as the previous one, because due to inflation these “downturns” also rise.

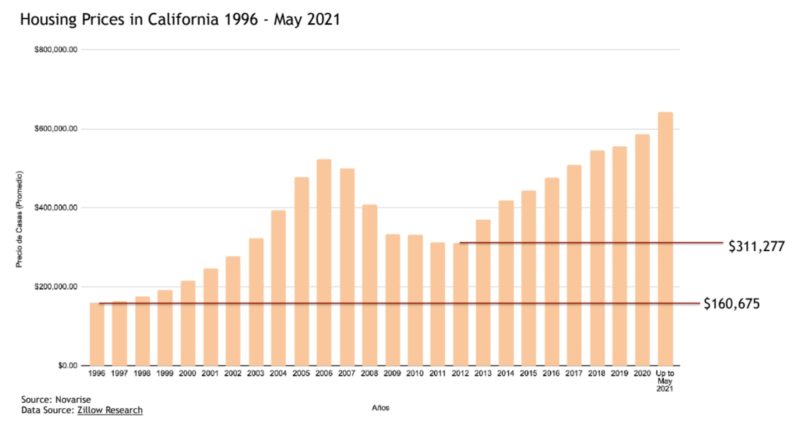

California

In the case of California, we can see in the graph that the variation was less volatile than Florida. The first downturn dates back to 1996, when the average home value was $160,675.

The new low point for prices also occurred in 2012, when homes hit $311,277.

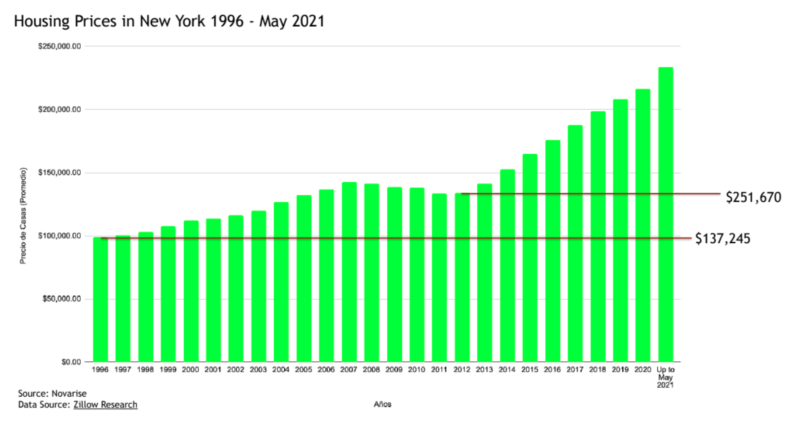

New York

In the graph, first of all we can see that it is a little more stable than the state of California. The first downturn also corresponds to 1996, when the average for a home was $137,245, while in 2012, the lowest value was $251,670.

In New York something very particular happens, and for this we must take into account the crises. Many people talk about the bubble of 2007 and 2008, but if we look at the graph, the blow that the New York real estate market received was almost minimal.

This shows that there are always different factors that influence the real estate market, and that realities can change from one state to another. Let’s remember that New York is a super tourist city, and there is a lot of work.

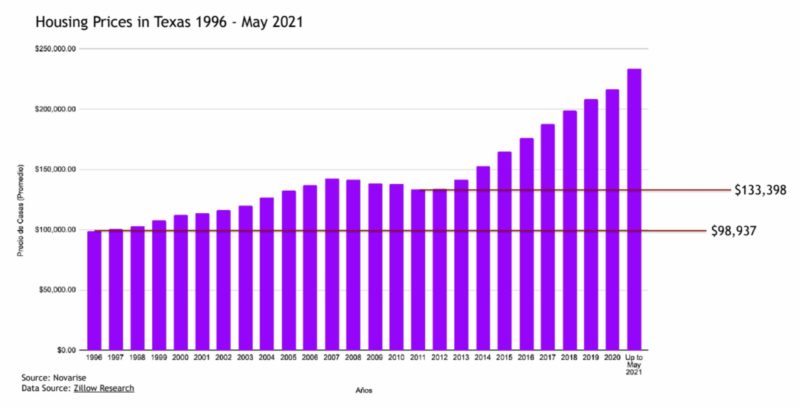

Texas

When talking about this controversial state, we can also see that the impact they suffered in 2008 was almost minimal. There was a downturn, but of very little relevance.

In this state, the lowest median home price also dates back to 1996, when the value was $98,000. Then, the second downturn was generated in 2011, reaching $133,398, and then continuing to rise without stopping until today.

With all this data, we want to show you there may be a lot of news, a lot of noise, and people can say many things, but what you must do is an analysis of the local market, because realities are always very different.

How to analyze the real estate market in the United States?

There is a very interesting free resource where you can get very valuable information about each state in the United States, for example, in the case of Texas, reports such as:

Ads

- Relocation Reports (people who migrate from one state to another).

- Quarterly housing report.

- Report of home buyers and sellers.

- Small land sales report.

- Luxury home sales report.

- And many more reports.

House value vs. Value of rents

We already discussed how the average price of homes has been moving in the real estate market in very important states in the United States, such as New York, Texas, California, and Florida. We conclude that there are always different factors that influence these price fluctuations. Now, let’s move on to analyzing the price of houses versus the rents.

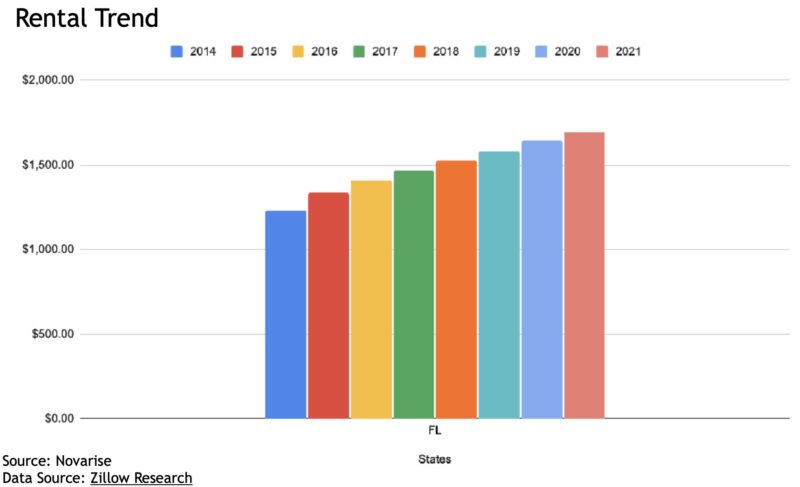

Florida

In the previous image you can see the trend of the increase in rents. As you can see, in the Florida area, rents have historically always been on the rise.

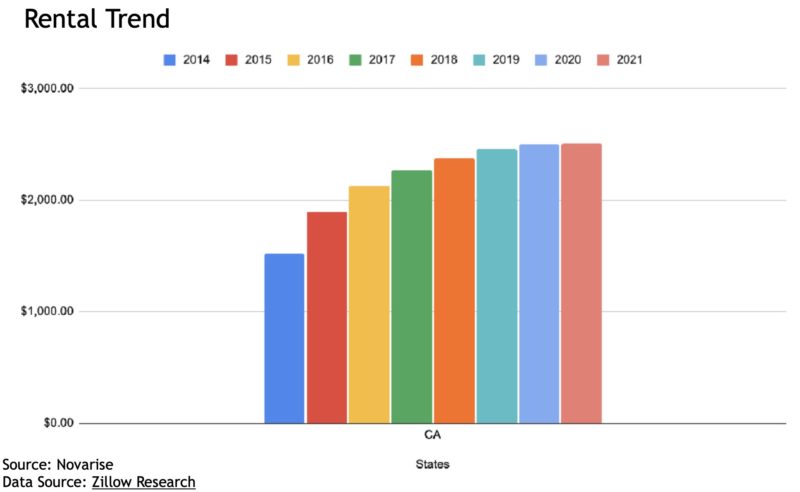

California

In the case of California, the same has happened. The price of rents has always been increasing steadily.

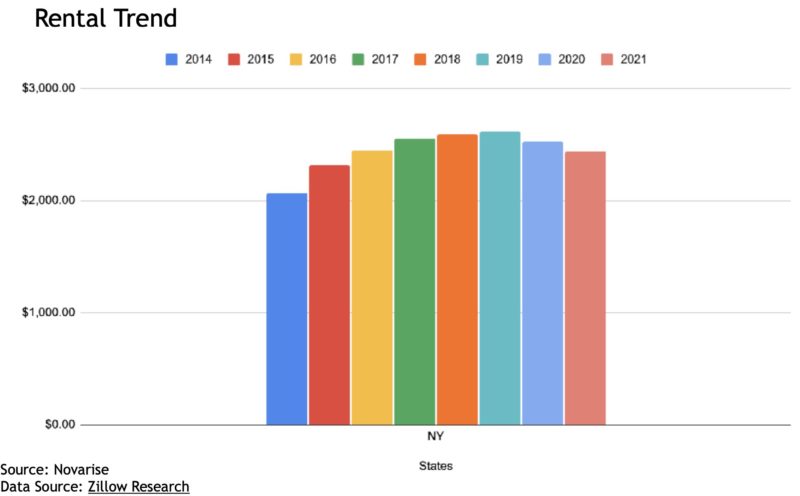

New York

In New York exactly the same has happened, the value of rents has always been rising. In 2020 something very particular happened: the graph shows a slight decrease in income, but this is due to the fact that New York became the epicenter of the pandemic, and therefore many people died, while others left out of fear.

In reality, it is not that the demand for rent in New York fell, it was simply an adjustment, since the people who lived in the city moved to other areas, and they moved depending on where the rent was cheaper in the same state.

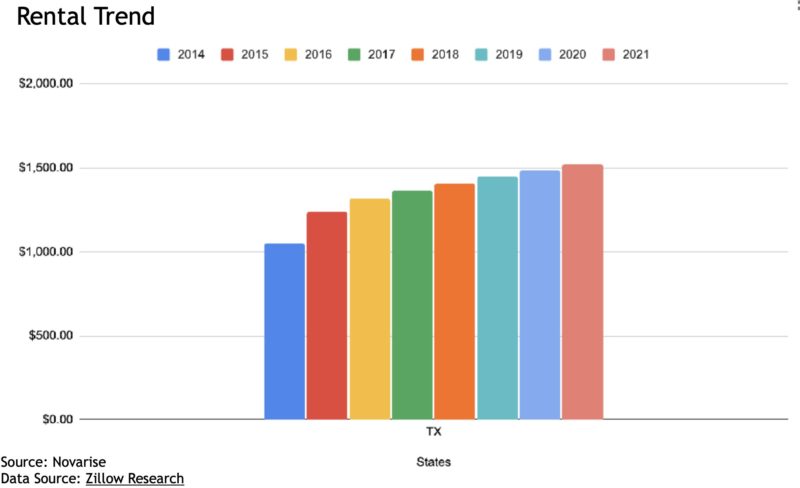

Texas

So: How to fight against the price of expensive houses?

The first thing we are going to tell you is that no, the solution, at least from our point of view, is not to enter a bidding war. The way to combat an expensive house is to add value. Our job as real estate investors is to add value to the community.

We are looking to add value to the community, and if the house is very expensive, as many are saying out there, be creative, simply look for a house that needs to be improved, and get the profits from it as we explained in the example that we give you at minute 48:00 of the video that you find at the top of this blog.

2020 crisis vs. What is happening today

Back in 2008, there was a lot of predatory lending. It is a system that was not working properly and that seriously hurt consumers with less financial education.

Many people were approved for mortgages, when in reality they did not have credit, they did not understand anything, they didn’t know how to handle money, and because of that they were harmed and lost their houses. These products still exist, but the difference is that nowadays the banks and the brokers ask for evidence, asking questions such as:

– Do you have experience investing?

– How many properties do you have?

– How long have you been investing?

In addition to simple questions, everything you say must be proven with your taxes. It may be that, depending on the company, if you already have a built reputation, they will be more flexible with loans. In general, predatory lending has already gone down in history.

Another thing that I would also like to emphasize is that many of the people failed because they didn’t know how an Adjustable Rate Mortgage (ARM) works.

If you are educated on the subject, you can use an ARM to your advantage, but for those who do not know how to handle an ARM, this can complicate your life. What happened back then is that a lot of people came in and bought their house with that mortgage, but signed without reading.

There was a small print in that contract that said, “We have this fixed rate for a certain time, but in a period of five years your mortgage will adjust to the interest or the rate that is in the market at that time.”

Many did not read that and what happened? After five years it was adjusted and it turns out that the new mortgage payment is much higher than what they were receiving in rent, and then they began to take money out of their pocket, something that was “profitable”, until the economy collapsed and both the owners and the tenants were affected.

Invest in a fixed rate mortgage

The strategy we are talking about today is to invest in a fixed rate mortgage, because we want to take advantage of the low interest rates that exist in the market, and keep that rate for the next 30 years to end up paying that mortgage with cheap money.

Also, one of the things that happened in 2008 is that people bought a lot of mortgages. People invested in the mortgages, they bought the debts, but those debts had collateral of little value. The collateral was the houses that were not worth it, and obviously the collateral was also a person who had no credit.

About mortgage forbearance

For those who were sitting waiting for the world to collapse, it is time to wake up because mortgage forbearance is being renegotiated.

Banks, the economy, the government, or whatever you want to call them, learned from their lesson of 2008 and now studies indicate that 77% of homeowners in default, have a repayment plan in place.

Now, what is happening many times is that the banks are negotiating with the owners about “How much can you pay? How do we extend this mortgage? How can we adjust the interests? All of that, to make sure that the owner continues to pay the mortgage.

Another important point is that mortgages in a “delinquent” status fell by 50%, compared to 2008, and that has to do with the negotiation so that those people in a delinquent status can catch up with their payments.

Inflation is “helping” with the rise in wages, which allows people to cover the mortgage expenses, whether you’re a homeowner or a tenant, thanks to its nominal value.

The projection on the rents and the supply of the houses

The supply of houses, once again, has been behind schedule since 2019, and the pandemic all it did was delay this even more. The problems that have occurred with electricity, the lack of wood, and other factors, have made everything slow down and get worse.

The cost of houses will continue to rise, according to projections. This will make it more difficult for families to have purchasing power to buy houses, simply because there is no capital, and therefore, the demand for rents will increase even more.

Rents are now relatively more stable compared to house prices, and we’re also talking about having the lowest interest and vacancy rates ever.

Analysis of interest rates and vacancies rates

Evaluating data from the 70s, 80s and 90s, we can see that in 1970 the rates were of 9%, 10%, and 12%. By 1980, the rates were between 14% and 17%. Now, when we compare this data with 2021, we find that today we have interest rates of 2.74%, that is, a minimum percentage compared to the others.

On the other hand, we have vacancies rates, and according to a Census Bureau report, the percentage of vacancies is 6.8%, which represents a historical low point. In addition, the data shows that during 2020 we entered a period of recession. Also, the vacancy rate for homeowners is even lower because no one wants to leave their homes.

Rents, once again, historically go up. Home prices may drop, but historical stats show that they always go up. The data from 1997 to 2021 say it, they are not going down.

Why is NOW the time to buy a house?

Based on our experience, the first thing to say is that there is no need to fear debt. Even if it is something that is in our DNA, the fact of being afraid of debt, we should work with them. The best thing to do is pay off your debts with OPM, because inflation destroys debts and the value of money.

Now, projections indicate that the houses will increase in value, but there is always the fear when thinking: What happens if the price falls? Because as we have seen, there is always a correction in the prices.

If the market does correct, the worst thing you can do is have your equity parked in your house. Why would it be the worst scenario? Let’s assume that your house is worth $500,000 today, and that it is already fully paid, which means that you do not owe anything on it. As we have explained before, the corrections in the markets exist, and it may be that in three years the value of that property will drop to $300,000.

Taking that hypothetical case into account, you will have lost $200,000 of your equity. If during that time, due to bad luck, you have an emergency and you want to obtain a cash-out refinance, you can only obtain it based on the amount of $300,000.

It is necessary to respect debts; you have to understand how to manage them in such a way that you can generate more wealth. Let’s work with inflation in a way that helps us protect ourselves. What matters at the end of the day is profit.

Again, don’t focus on how high home values are, don’t focus on the fact that in a month the Federal Reserve is going to raise interest rates. As long as you keep making money, keep making profits, keep having cash flow to meet your obligations and also to make profits at the end of the day, everything will be fine.

Remember that there is a problem in this society, and that is that there are not enough houses. There is high demand and low supply, and as long as that problem continues, we will continue to have affordability problems. Prices will continue to rise, and therefore there will be more demand, because there are more families who will not be able to buy houses, and therefore will need to rent.

FREE REAL ESTATE WEBINAR